Latest GST Council Meeting: Key Decisions and Their Impact

Latest GST Council Meeting: The GST Council, under the leadership of Finance Minister Nirmala Sitharaman, has approved several key changes in India’s tax structure. Operationalizing this will have far-reaching consequences on a host of sectors and goes further to demonstrate the government’s commitment to seeking a balance between the public welfare and revenue generation optimally. Here’s an elaboration of major decisions arrived at from the just-concluded meeting and what it implies.

GST Reduction on Cancer Drugs

One of the highly awaited changes after the meeting was the reduction of GST on cancer drugs. Earlier, this was taxed at a rate of 12%. The 5% reduction has now taken place. This is quite a huge stride in that it will help alleviate the budgetary burden on the patients.

The lowering of the tax rate is expected to bring timely relief to families bearing the high costs of cancer treatment. The government’s commitment to reducing healthcare costs is highlighted by its sensitive response to financial pressures caused by critical illnesses. This is going to help many people because the revision will lower not only the immediate financial burden but also may ease access to life-saving medications.

Exemption of GST on Funds Provided to Universities

At the meeting, central and state universities were exempted from paying taxes on their funding. This will benefit the higher education sector through eased access to funds without an additional burden of taxes.

GST exemption on university funding is among the broad moves to enhance the quality and access to higher education in the country. A reduction of the financial burden on the books of the institutions of higher learning will, no doubt, make it easy for the government to establish an enabling environment that promotes academic growth and innovation, thus culminating in better educational facilities and additional funds for student community and general educational community at large.

Also Read: Jayam Ravi Announces Divorce from Aarti Ravi (Continue Reading about Latest GST Council Meeting)

Health Insurance: No Changes

This was in the wake of much speculation and hope for the revision in the rate of GST on health insurance. To make health insurance more affordable by reducing its tax rate, which is higher than for other forms, was the general expectation. This anticipation did not see the light of day. Stakeholders have expressed disappointment that they have not been able to advocate for a revised GST on health insurance, leading to a call for a tax cut.

Health insurance is one aspect of financial security that many individuals and families rely on. To reduce insurance premiums and attract more subscribers, a GST cut was anticipated due to rising medical costs. If the public’s needs and changing healthcare requirements are not met under the same conditions, subsequent meetings may be necessary for further deliberations and considerations to address these issues.

Full Compliance and Explanations

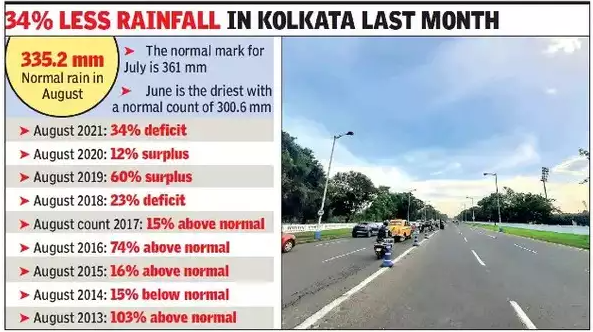

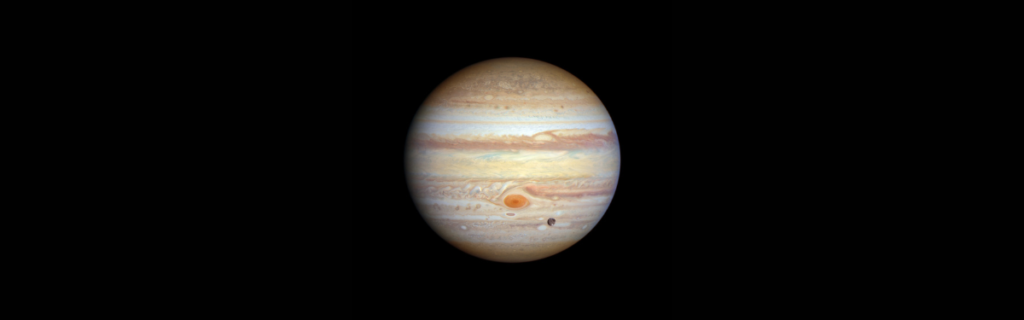

Image Source: Wikimedia Commons

The GST Council discussed major clarifications and compliances with respect to taxation of goods and services, in addition to these key changes. We ensured clarity and efficiency in tax administration by elucidating the existing tax guidelines. These talks are part of the big initiative of putting India’s taxation system into an effective and transparent system for business concerns and consumers alike.

Conclusion

The latest meeting of the GST Council has brought about some changes, reflecting the ongoing effort of the government to make the tax system more responsive and friendly to its citizens. Reduction in GST on drugs for cancer treatment is welcome because people use their hard-earned money to treat such a dreaded disease. Withdrawal of GST on university funding would go a long way to support and strengthen higher education.

In future deliberations, however, a reconsideration of this GST reduction on health insurance is likely. The nature of taxation in India necessitates continuous amendments, as this meeting marks a significant step in addressing the pressing areas of public interest while accommodating various economic and social interests.

On the whole, the council decisions epitomize the commitment to a delicate balance between financial relief in critical sectors and the need for effective revenue generation. Individuals, educational institutions, and the broader health system will shape future tax policies and public welfare strategies in India as these changes are implemented and their impact becomes apparent.